The Sukanya Samriddhi Account (SSA) Scheme is a small deposit scheme of the Government of India meant exclusively for a girl child. It was launched by Prime Minister Narendra Modi on 22nd January 2015 as a part of Beti Bachao Beti Padhao campaign. The scheme is meant to meet the education and marriage expenses of a girl child. This scheme encourages parents to build a fund for the future education and marriage expenses of their female child. It is operated through the all Post Offices, branches of Public Sector Banks and three Private Sector Banks viz. HDFC Bank, Axis Bank and ICICI Bank.

SSY Account Summary

| Name of the scheme | Sukanya Samriddhi Yojana |

| Starting date of Scheme | 22nd January 2015 |

| Scheme Started by | Central Government |

| Objective | The main objective of the scheme is meant to meet the education and marriage expenses of a girl child and this scheme encourages parents to build a fund for the future education and marriage expenses of their female child. |

| Beneficiary | Girl child till she attains the age of 10 years |

| Benefit of the scheme | 1. The Minimum Investment is ₹250 per annum, the Maximum Investment is ₹1,50,000 per annum and the Maturity Period is 21 years. 2. The account can be transferred anywhere in India from one post office/Bank to another. 3. A premature withdrawal of up to 50% of investment is allowed after the child gains the age of 18 years even if she is not getting married. |

| Application Process | Offline |

Eligibility criteria for the scheme

- The guardian can open the account immediately after the birth of the girl child till she attains the age of 10 years.

- Only one account is allowed per child.

- An account under this Scheme may be opened for a maximum of two girl children in one family.

Documents required for the Scheme

- Birth certificate of girl child

- Identity proof (as per RBI KYC guidelines)

- Residence proof (as per RBI KYC guidelines)

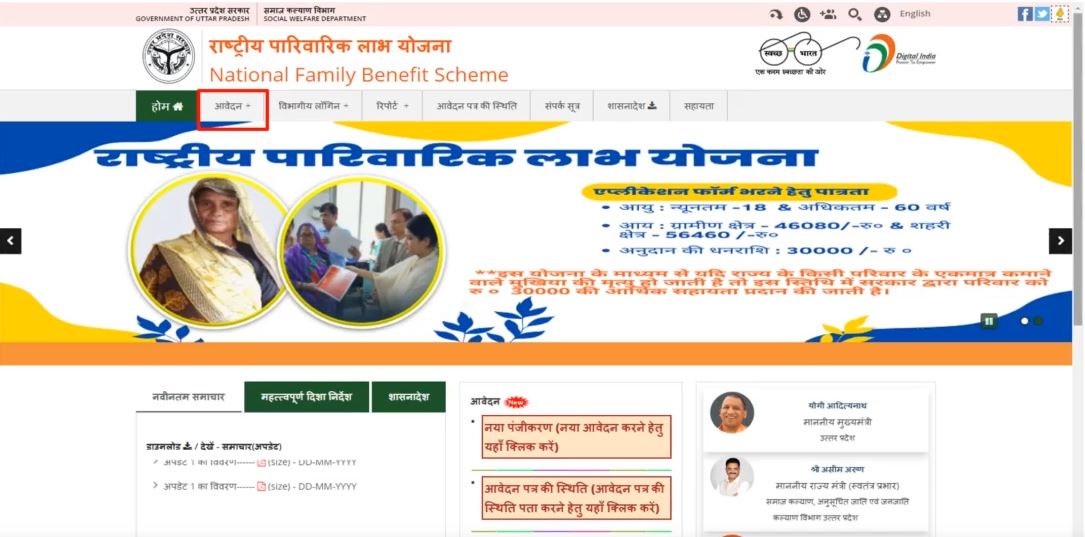

How to apply for SSY Account

Eligible guardian may apply offline for Sukanya Samriddhi Yojana (SSY) account can be opened at any participating bank or Post Office branch by given steps below.

Step1. Go to the bank or Post Office where you want to open the account.

Step2. Fill out the application form with the necessary information and attach supporting documents.

Step3. Pay the first deposit in cash, check, or demand draft. The payment can range between Rs.250 and Rs.1.5 lakh.

Step4. Your application and payment will be processed by the bank or the Post Office.

Steps5. After processing, your SSY account will be activated. A passbook will be supplied for this account to commemorate the account’s opening.

| Download Notification | Click Here |

| Whatsapp Group | Join Our Whatsapp Group for Latest Update |

| Official Website | Click Here |